Funding for Higher Education:

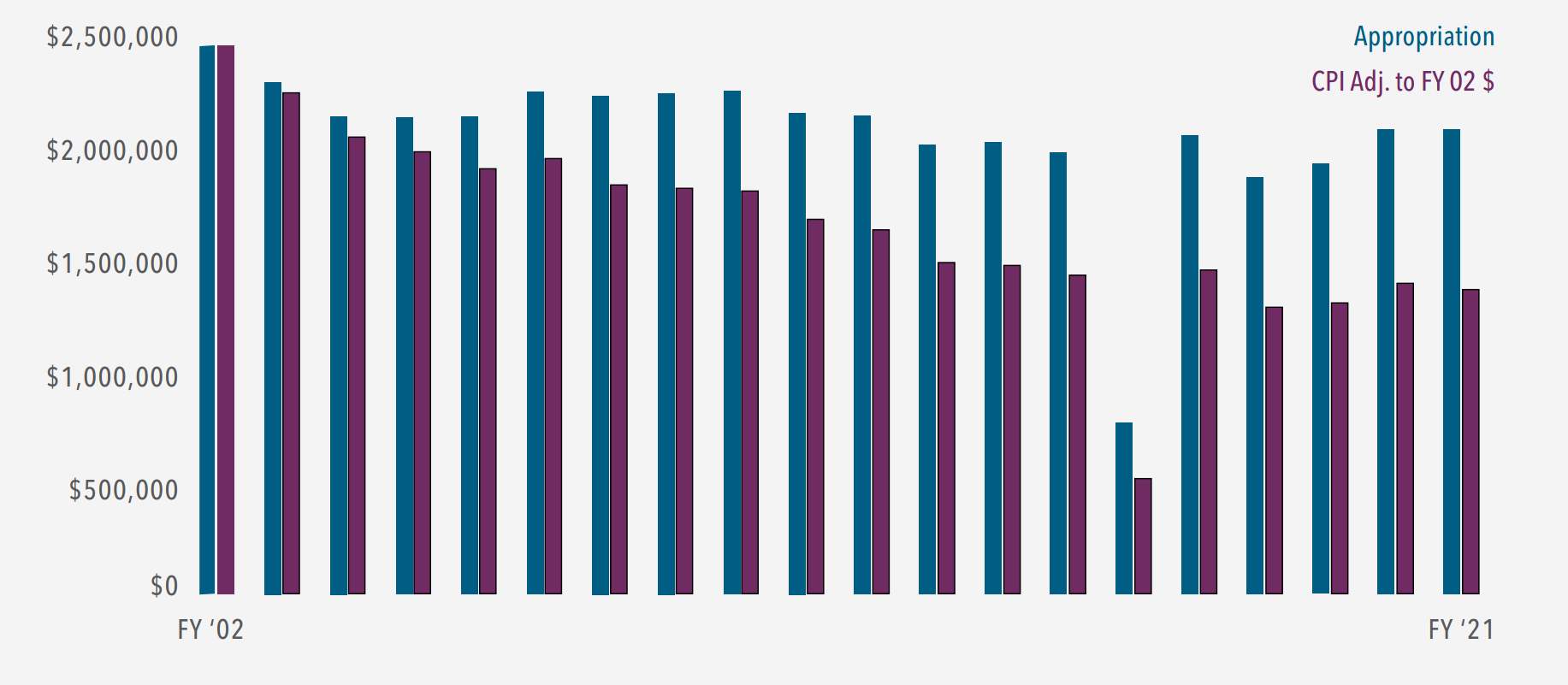

For years, Illinois has dramatically underfunded its higher education system. Since Fiscal Year 2002, higher education appropriations declined significantly in absolute terms. After accounting for inflation and new unfunded mandates, the buying power in Fiscal Year 2021 is just 55.5% of what it was in Fiscal Year 2002.

During the budget impasse, universities and community colleges received just 30% of Fiscal Year 2015 funding in Fiscal Year 2016, a cut of $1.2 billion to higher education.

As state appropriations for institutions declined, tuition increased. In FY 2002, state funds on average covered 72% of public university costs vs. 28% from tuition and fees. In FY 2020, the situation has flipped, with the state covering 35.6% vs. 64.4% from tuition and fees.

The impact for community colleges has been similar but shifts the burden to tuition and property taxes. In FY 2002, state appropriations on average covered 27.4% of costs, tuition and fees covered 30.6%, and property taxes the remaining 42%. In FY 2019, state appropriations had declined to 14.4% of community college costs, with tuition and fees covering 40.4%, and property taxes 45.2%. state appropriations had declined to 14.4% of community college costs, with tuition and fees covering 40.4%, and property taxes 45.2%.

The state has begun to make a turnaround, with Governor JB Pritzker’s Fiscal Year 2020 budget representing the largest percent increase in higher education funding since 1990, and that funding level being maintained despite the fiscal challenges brought on by the pandemic.

The buying power of Fiscal Year 2021 appropriations is

just 55.5% of what it was in Fiscal Year 2002.

HIGHER EDUCATION OPERATIONS APPROPRIATIONS

Adjusted for Mandates & Inflation (CPI-U)